What Is the Sutton Doctrine and How Does It Affect Subrogation?

Picture this scenario: A fire occurs at a building and causes significant property damage. At the time of the fire, the building was under the possession and control of the tenant, who had a written lease in place with the landlord. The landlord’s insurance carrier steps in and pays for the building damage. The investigation reveals the tenant was responsible for causing the fire. The landlord’s carrier then seeks to pursue the tenant as the responsible party in subrogation and seeks reimbursement of the amount they’ve paid to repair the building. Can the landlord’s insurance carrier legally pursue the tenant?

The insurer’s ability to proceed with a subrogation action against the tenant depends on the jurisdiction where the action lies as well as the language of the operative lease in place at the time of the fire. The analysis of those two factors will decide whether a tenant is considered an implied co-insured under the landlord’s insurance policy. If the tenant is an implied co-insured, then the landlord’s insurance carrier cannot pursue that entity because an insurer cannot pursue its own insured in subrogation regardless of liability. But wait! Can the law dictate that a tenant is insured under the landlord’s policy even when the landlord’s carrier never listed them as an insured or consented to insuring them? The Sutton Doctrine says in some instances – yes.

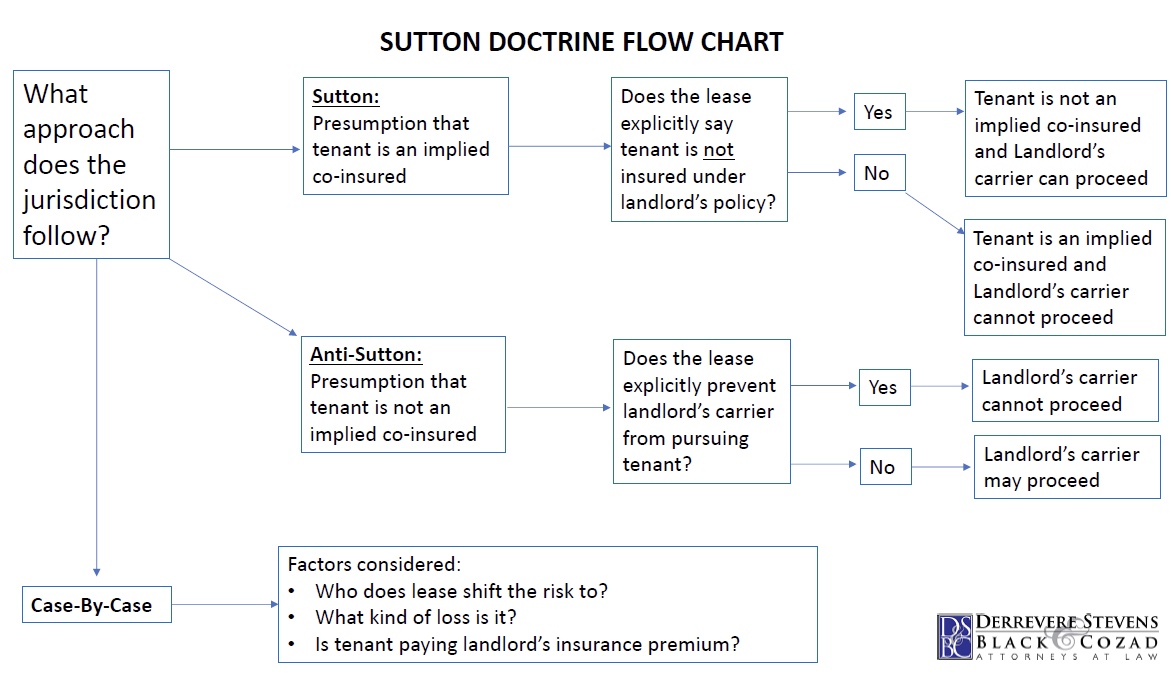

The first factor to look at is jurisdiction. Depending on where the subrogation claim will be litigated, there are three approaches that the courts take with respect to this issue. These are commonly known as the Sutton approach, the Anti-Sutton approach, and the case-by-case approach. Zurich American Insurance Company v. Puccini, LLC, 271 So. 3d 1079, 1081 (Fla. 3d DCA 2019).

The Sutton approach comes from an Oklahoma case where a landlord’s insurance carrier sought to pursue a negligent tenant for damage caused to the landlord’s property. That court stated “the law considers the tenant as a co-insured of the landlord absent an express agreement between them to the contrary. . .” Sutton v. Jondahl, 532 P.2d 478, 482 (Okl. Civ. App. 1975). Thus, in a jurisdiction that follows the Sutton approach, the lease must have express language allowing the landlord’s carrier to pursue the tenant, or the subrogation action is barred.

You can likely anticipate that the Anti-Sutton approach is just the opposite. In jurisdictions that follow the Anti-Sutton approach, a landlord’s insurer is permitted to bring a subrogation action against a tenant unless there is language in the lease prohibiting them from doing so. See generally State Farm Fla. Ins. Co. v. Loo, 27 So. 3d 747, 749 (Fla. 3d DCA 2010).

The case-by-case approach works just as it sounds. A court will evaluate each case on an individual basis. With this approach the court looks at the language in the lease to determine who the landlord and tenant intended would bear the risk in the event of a loss. Zurich, 271 So. 3d at 1082. If the lease terms say the tenant was intended to bear responsibility for a loss, then the tenant is not considered an implied co-insured on the landlord’s policy and the landlord can pursue them in subrogation. If the lease terms show the parties intended for the landlord to bear the risk, the tenant will be considered an implied co-insured under the landlord’s policy and the landlord’s insurance carrier will be barred from pursuing them in subrogation.

A review of case law on this topic provides guidance as to which lease terms the court considers when taking a case-by-case approach. In Loo, the determination was made looking at three things with respect to the lease: (1) there was nothing in the lease that absolved the tenant for its own negligence; (2) there was no lease term requiring the landlord to maintain insurance for the tenant’s benefit; and (3) no lease term held the landlord responsible for damage caused by the tenant’s negligence. State Farm, 27 So. 3d at 752. When reading that lease as a whole, the court determined the intent of the lease was for the tenant to bear responsibility for its own negligence, and the landlord’s carrier was permitted to pursue the tenant in subrogation. Similarly, in Puccini, the court looked at a lease term stating “Tenant shall be fully responsible for all repairs and damages if Premises are partially or totally destroyed by fire or any other casualty caused by Tenant or its agents.” Another crucial term swaying the court in that case stated Landlord was not responsible for making repairs if those repairs were necessitated by tenant’s negligence. Puccini, 271 So. 3d at 1083. Overall, the court in Puccini found the parties intended for tenant to bear the risk, and therefore the tenant was not considered an implied co-insured under the landlord’s policy.

Conversely, the Supreme Court in Massachusetts found that a lease term requiring the tenant to indemnify the landlord from all loss resulting from tenant’s carelessness, neglect, or improper conduct was not enough to shift the risk to the tenant for fire damage. Peterson v. Silva, 704 N.E. 2d 1163 (1999). In that case, the landlord’s insurance carrier was prevented from pursuing the tenant in subrogation when fire damage occurred because the lease did not specifically hold the tenant responsible for fire damage. Peterson was found to be applicable only in the limited circumstance of a fire by a Superior Court in Massachusetts. In that case, a pipe froze and burst due to the tenant’s failure to maintain adequate heat in the building which resulted in water damage. The court allowed the landlord’s insurance carrier to pursue the tenant in subrogation despite the Peterson decision because the holding in Peterson was limited to cases involving fire damage. Vermont Mutual Ins. Co. v. Veronica Munoz, No. 1981CV03374 (Mass. S. Ct. June 30, 2021). Another Massachusetts court followed Munoz’ lead finding that Peterson did not prevent the landlord’s carrier from pursuing the tenants in subrogation for water damage. In that case, multiple lease terms stated generally that the tenants would be responsible for damage caused by tenants or their invitees, and tenants were required to indemnify and hold the landlord harmless from all claims, damages and liabilities. RSUI Indemnity Company v. John Wolff et al., No. 2098CV00001EF (Mass. Trial Ct. E. NH Dist. July 9, 2021). What we learn from this line of case law is that the kind of loss involved matters, and that sometimes general provisions holding a tenant responsible for damage is not enough.

Always check the case law in your jurisdiction to find guidance on how your court will likely rule with respect to the tenant’s status as an implied co-insured. While each case should be examined individually based on its facts and the applicable law in that jurisdiction, here is the simplified summary of the three approaches:

- Sutton Approach: Tenant is considered an implied co-insured under the landlord’s policy unless the lease has express language stating otherwise.

- Anti-Sutton Approach: Tenant is not considered an implied co-insured under the landlord’s policy unless the lease has express language stating otherwise.

- Case-By-Case Approach: Court will look at the lease as a whole to determine who the parties intended would bear responsibility in the event of a loss.

Ultimately, not all leases are written the same and many require a court’s interpretation of the parties’ intent based on the language. Case law can provide guidance, but because many cases are unique in their facts and lease terms, there are often arguments to be made on both sides of this issue. The best ammunition you can have to sway a court’s decision in your favor is to be thorough with your case law research and present the court with examples that are either similar or distinguishable from your facts to establish why your argument should prevail.